1. You are not on your own

Your private savings are contributed to by your employer and the state.

2% of salary + up to 2% voluntarily

1.5% of salary + up to 2.5% voluntarily

PLN 250 as a welcome contribution + PLN 240 every year

Managed by a financial institution selected in your company

Any foreigner can become a PPK participant on equal terms to Polish citizens. Participation in the programme is voluntary. Any employed person over the age of 18 and under the age of 70 can become a PPK participant.

Employees under the age of 55 join the scheme automatically. If they don’t resign, the employer will enroll them in PPK no earlier than after 14 days of employment and no later than the 10th day of the month following the month in which the period of 3 months (90 days) of employment expired. Employees over the age of 55 must submit an application to their employer in order to save in PPK – it is available here. The employer is required to inform them of this possibility.

If an employee changes their mind after resigning from PPK, they can start saving as part of the scheme at any time. All they need to do is submit a suitable application to their employer:

• to make contributions to PPK or

• to enter into a PPK operating agreement if the employee is over 55 years of age.

Your private savings are contributed to by your employer and the state.

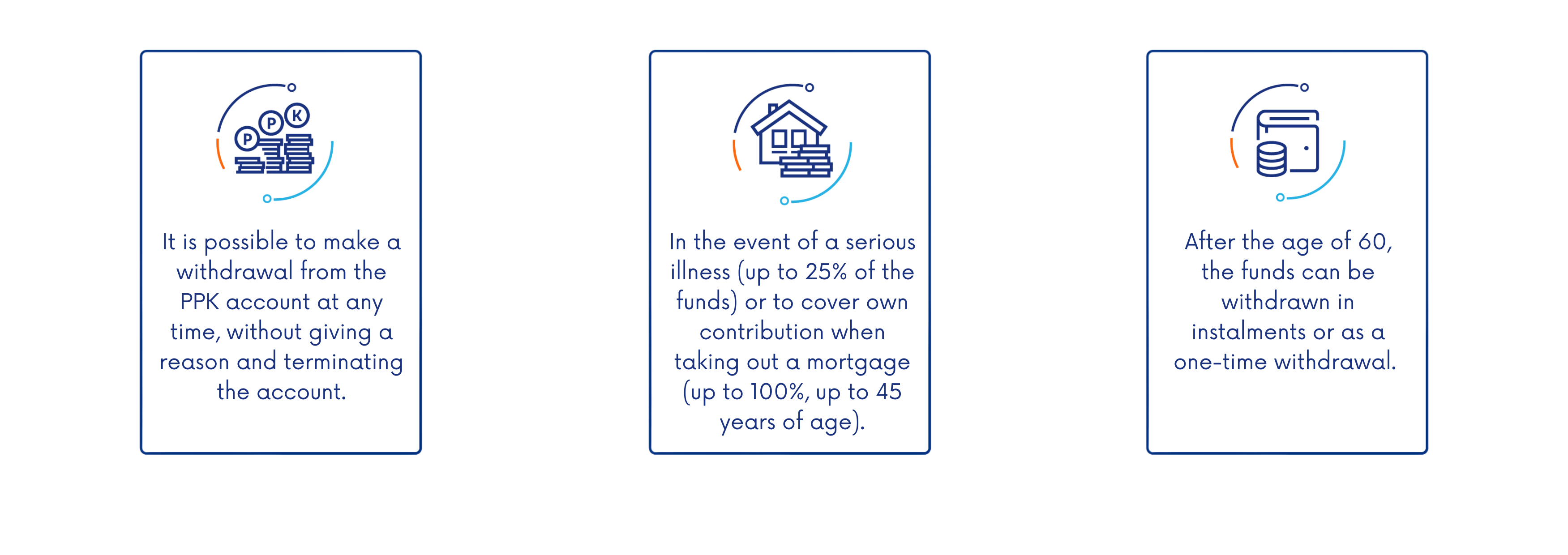

The funds accumulated in PPK are your private property. It is up to you when and in what form you will use the funds accumulated in PPK.

In the event of your death, the savings accumulated in your PPK account do not become forfeited. They can be inherited. You decide who will receive them.

Savings are accumulated in your individual PPK account of the financial institution that operates PPK in your company. These institutions are kept under strict control. Once your employer sign in your name, you will receive login data to always have access to information on your savings. You can also check the balance of your funds on the dedicated website, available here. Your savings are stored in a fund suited to your age (the so-called target date fund) and invested.